Jitsu!

Same company. Same values.

Same team of dedicated last-mile delivery experts.

Same team of dedicated last-mile delivery experts.

A Word from Our CEO Raj Ramanan

Delivery Matters

We provide the essential software infrastructure and services for brands to maintain their “customer experience” into the hands of their customers

Better Than

99%

On-Time Delivery

While others face challenges with punctual package delivery, Jitsu consistently delivers with exceptional reliability. The improvement will be evident to your customers.

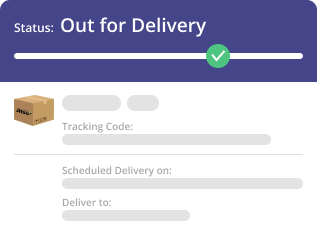

Managed Delivery Experience

Jitsu delivers a complete customer experience to the door, allowing brand managers to monitor, shape and optimize delivery with analytics.

Delivering Sustainbility

Our delivery network model merges with AI-powered software to enable us to significantly lower CO2 emissions by selecting the most suitable vehicles and routes.

Exceeding Expectations

We’ll do the same for you.

>99%

On Time Deliveries7 days

per Week21 of 25

Largest Metro Areas144%

Net Rev RetentionTrusted by World-Class Customers

We’re Here to Help

Making a change to your last-mile delivery partner is a big decision. Our team of last-mile delivery experts will work with you and your team to show how and why Jitsu is a better fit for your brand.

But the first step is to contact us.

But the first step is to contact us.